Top Tips to Help Improve Your Cash Flow

All businesses are susceptible to cash flow problems. To overcome this risk, and to identify and prevent potential difficulties, you should diligently monitor your business’ finances. The following overview provides financial forecasting strategies to help improve your cash flow.

Forecasting Your Cash Flow

Estimating your business’ cash flow is essential for success, because it helps keep your business viable and prepared for risks. ‘Cash flow’ is the money coming in and out of your business. You should closely monitor what you are owed to ensure prompt payment from customers, and also what you spend to ensure your costs do not outweigh your income. Balancing the two will help you plan for the future, including deciding when the most opportune time to institute a sales push is, collecting on late payments or taking out a loan.

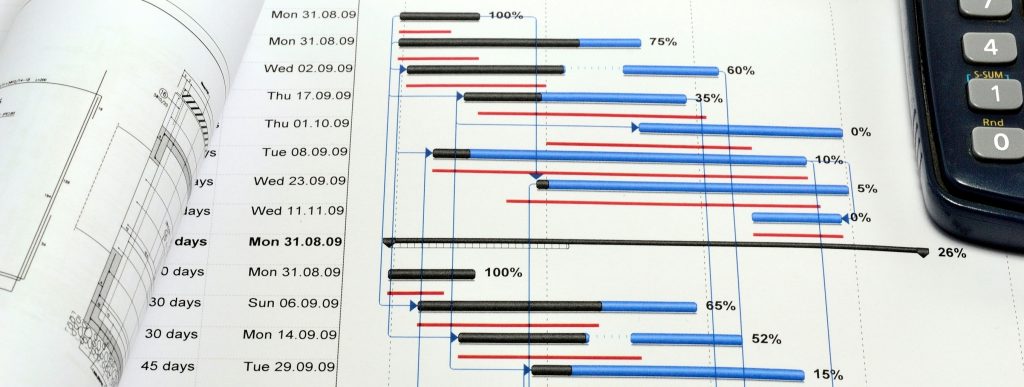

To maintain this balance, you will need to develop these three financial forecasts, in the order they are listed, to arrive at an accurate cash flow forecast.

- Sales forecasts estimate your business’ expected sales from month to month. This involves calculating your projected sales revenue, or the number of units you plan to sell multiplied by the price of each unit. Your projected sales revenue is based on assumptions such as your market share, resources, pricing and competition. Sales forecasts need to show the sales income you expect each month based on realistic expectations.

- Profit and loss forecasts incorporate your sales forecast and your costs to determine how profitable you expect your business to be. You should include expected revenue, cost of sales, gross profit and net profit.

- Cash flow forecasts build off the sales and profit and loss forecasts you have already done to estimate whether you will run short of cash at any time. Your cash flow forecast should include any costs not accounted for in the first two forecasts, such as stock, material, equipment, wages, rent, utilities and daily operating expenses. Also include any income left out of the first two forecasts, such as interest on savings or shareholder investments. This information, coupled with knowledge of your customers’ payment patterns and when your bills are due will allow you to analyse the cash moving in and out of your business on any given day.

You should now have a clear picture of your business’ income, costs and cash flow and be able to address the following common barriers to the movement of cash:

- Many payments becoming overdue at the same time

- Difficulty in paying bills or suppliers

- Rapid, unchecked business growth

Cash flow forecasting helps solve these problems by predicting when cash will flow in and out of your business. It enables you to predict the timing of any surplus or shortfall of cash and encourages sustainable business growth.

You should update your figures and projections on a weekly or monthly basis. Regular updates will help reveal patterns in your cash flow, uncover discrepancies between spending and estimates, and fix the causes for those discrepancies.

Identifying and Solving Problems

After developing your business’ cash flow forecast, you can start identifying and solving potential problems. Regularly monitoring your payments received will help you understand customer payment patterns and identify irregularities. One way you can do this is by noting the number of days it takes a customer to pay from the day the invoice is sent. If the customer’s payments suddenly become habitually late or erratic, you can use your cash flow forecast to determine how the customer’s new payment pattern will affect your cash flow and find ways to replace any lost cash.

Tactics that customers may use when delaying a payment include:

- Incorrectly completing or not signing cheques

- Habitually asking you to resend an invoice

- Routinely assuring you the ‘late cheque is in the post’

- Ignoring or not returning phone calls and email

Reducing the risk of late or non-payment from the outset fosters predictable cash flow. Keep your cash flowing smoothly with the following tips:

- Carry out credit checks before supplying goods and services. You can use a credit agency or conduct your own research.

- State payment conditions clearly on all your invoices. Include a statement specifying what will happen in the event of a late payment.

- Send out invoices promptly. Use email or first-class post for speed.

- Think about using a computerised credit management system. It will help keep track of customers and generate reminders when payments are late.

- Define and implement your collection strategy. A staggered collection process helps you track a payment at each step.

- Set monthly payment targets. Meeting your targets will mean reliable cash collection and an accurate picture of monthly revenue.

- Offer online payments. Online payments help expedite the payment process.

- Take out credit insurance. It covers you in the event that a customer becomes insolvent and you are saddled with bad debt.

Overtrading

One of the most common challenges to young and growing businesses is overtrading, or taking on more work than you can handle. Overtrading is detrimental to a business’ cash flow—it prompts a business to pay a large amount of cash long before the additional income is due, often by paying suppliers, increased wages and by purchasing new equipment or larger premises. Overtrading makes it possible for a business to fail even with a large order on the books.

There are several ways to reduce the risk of overtrading:

- ‘Just in time’ ordering reduces the demand on working capital by ordering stock as the business needs it, rather than in advance.

- Effective debt management ensures your business is paid quickly so it has more cash available to pay suppliers and staff.

- Investigating all areas of business spending helps uncover areas of your business where you can regain more control over cash flow.

For more information on the common pitfalls facing new and growing businesses, contact the insurance professionals at NC Stirling today.

NC Stirling provide specialist insurance advice to companies operating in the private and third sectors including new start up’s, growing companies and charities & other not-for-profits.